Navigating natural capital: from the boardroom to the ground.

Author: Ian Rollins – Managing Director, Niche

July 18, 2023

News & Insights

Natural capital accounting is not an abstract issue

Understanding the cost, and value, of an organisation’s dependence on, impact upon, and contribution to the natural environment is increasingly important in boardrooms across Australia and around the world. International policy is aligning with commercial recognition of the true value of natural resources to global economies, and of their increasing scarcity.

For many of Niche’s clients, natural capital accounting is not an abstract issue. Some are already experiencing challenges to their traditional business model due to shortages of natural resources.

Others are caught between the competing urgency to develop projects while at the same time preserving and protecting biodiversity. The rubber hits the road when these companies are faced with the reality of compliance-based biodiversity offsetting, effects on project cost and approval timeframes, and the increasing costs and difficulty of this due to the limited supply of quality biodiversity offsets.

Such limited remaining supply of high functioning nature, and mounting pressure to act, provides an opportunity to participate in existing and emerging natural capital markets. It also poses the real challenge of engaging with complex reporting frameworks.

The reporting dilemma: getting lost in the maze

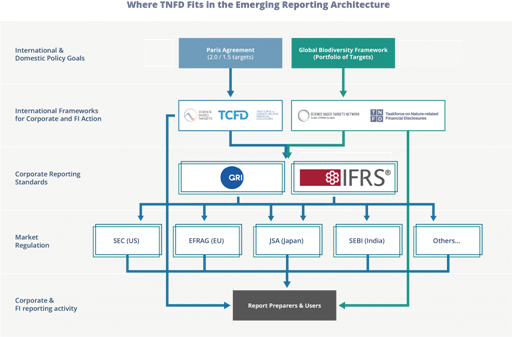

Many boards and organisations are already reporting on sustainability and climate-related risks. But with the Taskforce on Nature-related Financial Disclosures (TNFD) to publish its recommendations in September this year, organisations are grappling with the further implications of reporting on a broader range of environment-related risks.

While understanding and accounting for carbon impacts has challenges, that is still a simpler calculation than grappling with all the ways that changes in the natural environment and biodiversity may affect a business.

Where TNFD fits in the emerging reporting architecture.

Source: https://framework.tnfd.global/introduction-to-the-framework/executive-summary/v04-beta-release/.

A further challenge comes from the number of overlapping accounting methods and merging and complex frameworks: ISSB global sustainability disclosure standards; Science-based targets initiatives (SBTI); TNFD; not to mention state and federal biodiversity regulations organisations must comply with to continue business activities. There is a real risk that navigating the reporting frameworks becomes an end in itself. We may all miss the forests while we’re busy counting trees. And reporting frameworks may remain just that — frameworks without any evidence of real nature being protected and restored.

There is an inherent tension here. Organisations will need to work within the frameworks, account for their natural capital risks and opportunities, and showcase the value of projects to shareholders and to the world. Creating meaningful environmental impacts will also require organisations to move beyond the frameworks and build lasting projects on the ground.

Striking that balance will be challenging. However, Niche’s experience to date suggests four keys to navigating natural capital strategies, markets and projects.

Start now and think long term

Yes, there is an urgency to act. But we also need to think on much longer timescales about restoring environments and protecting existing habitats.

Companies should focus on the creation of practical nature strategies that sit alongside the long-term organisational strategy. Avoid the twin traps of aiming for quick wins or setting unattainable targets. You can establish appropriate metrics now that make sense to your business, so success can be counted in terms of sustainability and measured on the ground against realistic timescales.

Creating biodiversity supply means protecting and restoring habitats. This requires understanding that natural systems and processes can take generations, hundreds of years to mature.

Alongside this, negotiated covenants with landholders who ultimately need to allow these projects on their land may be for 25 years or in perpetuity. Most will have lifelong or intergenerational effect.

That is a very different timescale to the corporate reporting cycles or rapid payback ROI calculations many organisations are used to. Establishing an appreciation for this time scale is critical to success.

In our experience, the key is to start now, build something small, but think long term.

Grow connections and find common ground

I see Niche’s role as helping clients navigate challenges both in the boardroom and on the ground.

As we work with clients to move beyond reporting frameworks and to create concrete and enduring change, we recognise that boards and corporates need to have a strategy, to establish clear objectives, satisfy reporting obligations and communicate to stakeholders. But that needs to be balanced with clear-eyed advice about how a strategy can translate into execution. Otherwise, there is a real risk of producing a great-looking slide deck that will never survive the first negotiations with landholders trying to feed their families.

We work with clients to move beyond reporting frameworks and to create concrete and enduring change.

For us, that means being also willing to do the groundwork, to walk the land and understand what is really there, and to engage meaningfully with landholders’ commercial needs and objectives. Then it means drawing on technical expertise and knowledge to measure biodiversity, respectfully engage with cultural heritage, understand the ecological systems, manage habitats, and rebuild landscapes.

Ultimately, the key to navigating the emerging natural capital markets will be finding trusted partners to support the end-to-end life cycle of a natural capital strategy.

In our experience, that can involve considerable translation on both sides of the supply-and-demand equation.

And again taking that long-term view, to build lasting relationships and work with landholders to deliver on those plans.

Embrace uncertainty

Biodiversity loss and climate change are ‘wicked problems’, with complex and sometimes conflicting interdependencies and no clear solutions.

Natural systems are uncertain, and interventions are likely to involve a degree of trial and error. Some may not work.

As scientific and ecological information changes, there is a reality that strategies will need to adapt.

Organisations need to find a way of managing that level of uncertainty, engaging with new information and communicating their lessons learned as well as successes.

Those that genuinely want to create positive change will be able to work through the uncertainties and risks and start to see an impact.

Some that are purely focused on the financial wins or positive spins will struggle. But I think those that genuinely want to create positive change will be able to work through the uncertainties and risks and start to see an impact.

There are opportunities to achieve excellence. But when it comes to natural environments and systems, sometimes persistence needs to be part of your solution.

Build trust and demand transparency

Even as the economic importance of nature becomes clear, natural capital markets can seem opaque.

As with any new market, there can be a lot of ambiguity. There are endless options to measure nature, and it is still unclear what biodiversity metrics should be tracked.

Natural capital markets are still illiquid, and market drivers may conflict. Balancing potential returns against effects on land valuation, taxation implications, risks, and flexibility for future generations can be a complex calculation.

To help corporate clients access and create biodiversity supply, we also need to work with landholder clients to help them bring their product to market.

To navigate all of this well, you need to establish trust on both sides of the deal. It is essential to understand who stands to benefit and that any conflicts of interest are clearly disclosed.

For us, the key to building trust and long-term relationships is relentless transparency, about the costs, the opportunities as well as uncertainties.

And for all the challenges, I am optimistic. About the opportunities for our clients and the role Niche can play in helping clients better account for the value of finite natural resources. In over a decade of working with clients to reimagine development opportunities, we are delivering results and seeing that sustainable growth is possible.

About the author

Ian Rollins – Managing Director, Niche

As one of Australia’s environmental leaders, Ian Rollins has 17 years of experience leading, designing, and delivering large-scale environmental programs. Before joining Niche, Ian was the Chief Operating Officer of Greening Australia and Managing Director of Canopy, one of Australia’s largest carbon reforestation companies. Combined with an international career with mining companies such as BHP, South32 and Old Castle, he has gained practical insight into the land, resources, energy and agricultural sectors and has honed an exceptional ability to identify and develop natural capital projects through environmental markets.

Ian is a passionate, innovative, and future-focused leader who enjoys helping teams successfully navigate the intersection between commercial and environmental outcomes. His experience growing businesses in both the for-profit and not-for-profit sectors has provided him a unique advantage to identify and develop win-win solutions for business, communities and the environment.

Read more

TNFD Pilot Program – project cast study

Natural Capital and Offsetting

The future looks bright at Niche – Ian Rollins shares his vision for 2023 and beyond

About Niche

Contact Niche

About Niche

Our people

Latest news

Projects

Excellence in your environment